When it comes to small business loans, Kabbage has become a household name in the financial world. But is Kabbage legit? This question is crucial for entrepreneurs and small business owners who are looking for reliable funding options. In this article, we will delve into the legitimacy of Kabbage, its services, and how it operates to help you make an informed decision.

As the financial landscape continues to evolve, more businesses are turning to online lending platforms like Kabbage for quick and easy access to capital. However, with the rise of digital lending services, it's important to ensure that the platform you choose is trustworthy and credible.

This article will provide an in-depth analysis of Kabbage's legitimacy, including its business model, customer reviews, and regulatory compliance. By the end of this guide, you'll have a clear understanding of whether Kabbage is a legitimate option for your business financing needs.

Read also:What Is The Difference Between Tablet And Ipad A Comprehensive Guide

Table of Contents

- What is Kabbage?

- Is Kabbage Legit?

- Kabbage Services and Features

- How Kabbage Works

- Customer Reviews and Testimonials

- Regulatory Compliance and Security

- Comparison with Other Lenders

- Costs and Fees Associated with Kabbage

- Common Questions About Kabbage

- Conclusion and Final Thoughts

What is Kabbage?

Kabbage is an online lending platform that specializes in providing working capital solutions for small businesses. Founded in 2009, Kabbage quickly gained popularity due to its innovative approach to lending, which focuses on using data analytics to assess the creditworthiness of businesses rather than relying solely on traditional credit scores.

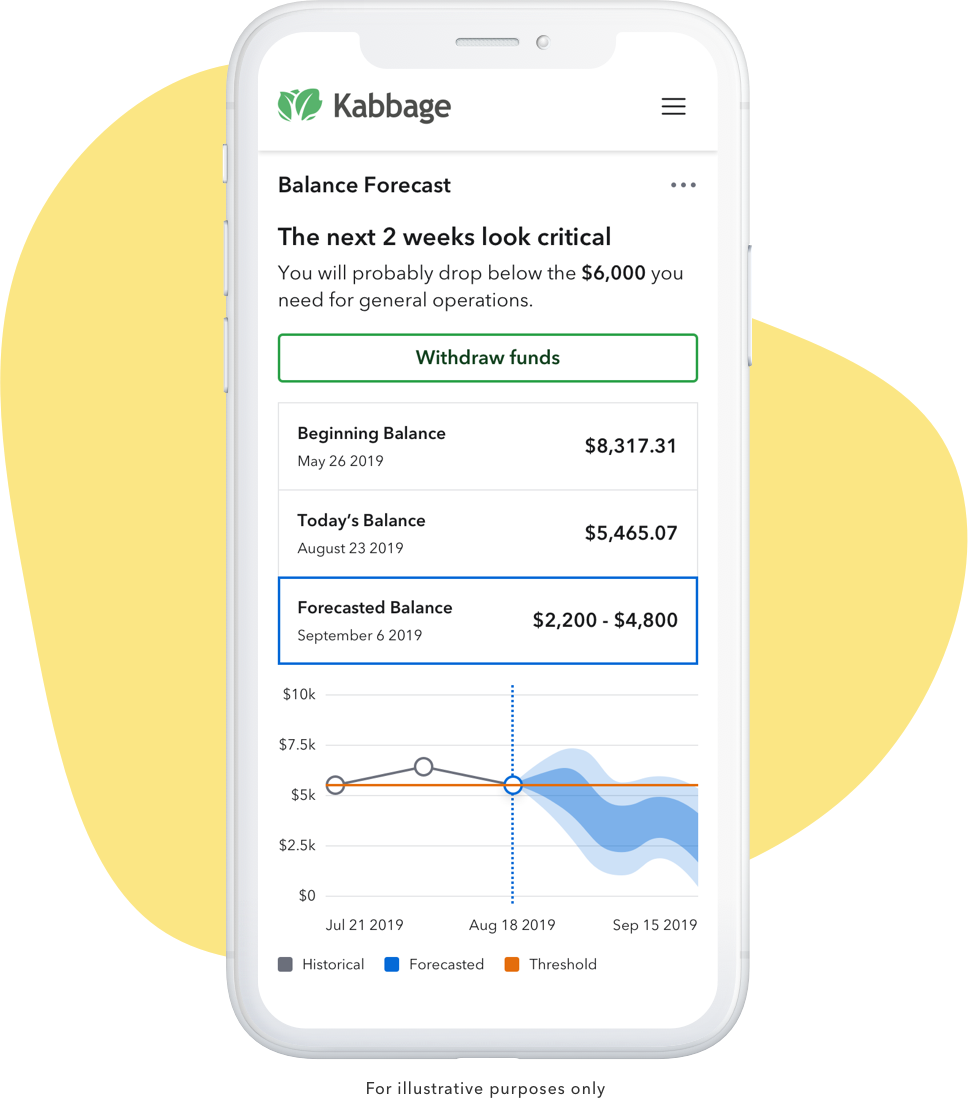

The platform offers flexible loan options, including lines of credit, term loans, and invoice financing. Kabbage's primary goal is to simplify the borrowing process for small businesses by offering fast approvals and easy access to funds.

Key Features of Kabbage

- Quick application process

- Fast funding within 24 hours

- Flexible repayment options

- Data-driven underwriting

- Accessible through a user-friendly platform

Is Kabbage Legit?

One of the most common questions among potential borrowers is, "Is Kabbage legit?" The short answer is yes, Kabbage is a legitimate lending platform. It has established itself as a reputable name in the fintech industry and has served over 100,000 small businesses with more than $6 billion in funding.

Kabbage's legitimacy is supported by its partnerships with major financial institutions, such as American Express and ING. Additionally, the platform is regulated by the appropriate financial authorities, ensuring compliance with industry standards and consumer protection laws.

Signs That Kabbage is Legitimate

- Regulated by financial authorities

- Transparent terms and conditions

- Positive reviews from verified customers

- Partnerships with reputable financial institutions

Kabbage Services and Features

Kabbage offers a range of financial products designed to meet the needs of small businesses. These services include lines of credit, term loans, and invoice financing. Each product is tailored to address specific funding requirements and comes with flexible repayment options.

Types of Loans Offered by Kabbage

- Lines of Credit: Provides businesses with access to a revolving credit line that can be drawn upon as needed.

- Term Loans: Offers a lump sum of money that is repaid over a fixed period with predetermined interest rates.

- Invoice Financing: Allows businesses to borrow against outstanding invoices, providing immediate cash flow.

How Kabbage Works

The Kabbage platform operates by leveraging data analytics to assess the financial health of businesses. During the application process, borrowers are required to connect their business accounts, such as bank accounts, payment processors, and accounting software. This data is then analyzed to determine creditworthiness and loan eligibility.

Read also:Chinese Calendar True Or False Ndash Unveiling The Truth Behind The Ancient Timekeeping System

Steps to Apply for a Kabbage Loan

- Sign up for a Kabbage account

- Connect your business accounts

- Complete the online application

- Receive an instant decision

- Access funds within 24 hours

Customer Reviews and Testimonials

Customer feedback plays a crucial role in determining the legitimacy of any financial service provider. Kabbage has received overwhelmingly positive reviews from its users, who appreciate the platform's speed, convenience, and customer support.

According to a survey conducted by Kabbage, over 90% of customers reported satisfaction with the platform's services. Many borrowers have highlighted the ease of the application process and the quick turnaround time for funding as key advantages.

Common Positive Feedback

- Fast and efficient application process

- Transparent communication

- Responsive customer service

Regulatory Compliance and Security

Kabbage adheres to strict regulatory standards to ensure the safety and security of its customers' data. The platform is compliant with the Federal Trade Commission (FTC) guidelines and the Gramm-Leach-Bliley Act (GLBA), which govern the protection of consumer financial information.

In addition to regulatory compliance, Kabbage employs advanced encryption technologies to safeguard sensitive data. This ensures that all transactions and communications are secure and protected from unauthorized access.

Key Security Measures

- Data encryption

- Two-factor authentication

- Regular security audits

Comparison with Other Lenders

While Kabbage is a popular choice for small business loans, it's important to compare it with other lending platforms to make an informed decision. Some of the key competitors in the market include OnDeck, BlueVine, and Fundbox.

When evaluating these options, consider factors such as interest rates, loan terms, and customer service. Kabbage stands out due to its innovative approach to lending and its focus on providing personalized solutions for small businesses.

Comparison Chart

| Lender | Loan Types | Interest Rates | Repayment Terms |

|---|---|---|---|

| Kabbage | Lines of credit, term loans, invoice financing | 1.5% - 10% per month | 6 - 12 months |

| OnDeck | Term loans, lines of credit | 7% - 36% APR | 3 - 36 months |

| BlueVine | Lines of credit, invoice factoring | 3% - 9% per 12 weeks | Flexible |

Costs and Fees Associated with Kabbage

Understanding the costs and fees associated with Kabbage is essential for making an informed decision. The platform charges interest rates that vary based on the borrower's creditworthiness and the type of loan selected. Additionally, there may be fees for late payments or early repayment.

It's important to carefully review the terms and conditions before signing up for a Kabbage loan to ensure that you fully understand the financial commitment involved.

Key Costs and Fees

- Interest rates: 1.5% - 10% per month

- Late payment fees: $15 - $50

- Early repayment fees: May apply depending on the loan terms

Common Questions About Kabbage

Here are some frequently asked questions about Kabbage:

1. What types of businesses are eligible for Kabbage loans?

Kabbage serves a wide range of small businesses, including retail stores, service providers, and e-commerce companies. To qualify, businesses must have been operational for at least one year and generate a minimum monthly revenue of $4,000.

2. How long does it take to get approved for a Kabbage loan?

Most applicants receive an instant decision after completing the online application process. If approved, funds are typically available within 24 hours.

3. Are there any hidden fees with Kabbage?

Kabbage strives to maintain transparency in its pricing structure. All fees and charges are clearly outlined in the loan agreement, ensuring that there are no surprises for borrowers.

Conclusion and Final Thoughts

In conclusion, Kabbage is a legitimate and reliable platform for small business loans. Its innovative approach to lending, combined with its focus on customer satisfaction, makes it a popular choice among entrepreneurs and business owners.

Before applying for a Kabbage loan, it's important to carefully evaluate your financial needs and ensure that the terms and conditions align with your business goals. If you're looking for a fast and convenient way to access capital, Kabbage is definitely worth considering.

We encourage you to leave your thoughts and questions in the comments section below. Additionally, feel free to share this article with others who may benefit from the information provided. For more insights on small business financing, explore our other articles and resources.

Data Source: Kabbage official website, Federal Trade Commission, and industry reports.