The debate over whether to rent or buy a home has been a long-standing topic of discussion for individuals and families alike. With insights from The New York Times, this article delves into the financial, emotional, and practical aspects of renting versus buying. Understanding the nuances of each option can help you make an informed decision tailored to your unique circumstances.

This article explores key considerations such as market trends, long-term financial implications, lifestyle preferences, and expert opinions. By the end, you'll have a clearer understanding of which option might be better for you—whether you're a first-time homebuyer or someone reevaluating their living situation.

As we navigate the complexities of housing in today's economy, it's crucial to weigh the pros and cons of renting versus buying. This guide will provide actionable insights and reliable data to assist you in making one of life's most significant financial decisions.

Read also:What Is The Difference Between Tablet And Ipad A Comprehensive Guide

Table of Contents

- Introduction to Rent vs Buy

- Market Trends: What The New York Times Says

- Financial Implications of Renting vs Buying

- Lifestyle Factors to Consider

- Is Buying a Home a Long-Term Investment?

- Emotional Aspects of Renting vs Buying

- Expert Perspectives on Rent vs Buy

- Using a Rent vs Buy Calculator

- Case Studies: Real-Life Examples

- Conclusion and Call to Action

Introduction to Rent vs Buy

Why the Rent vs Buy Debate Matters

Deciding between renting and buying a home is more than just a financial decision—it's a lifestyle choice with long-term implications. According to The New York Times, the housing market is constantly evolving, influenced by factors such as interest rates, economic conditions, and demographic shifts. Understanding these dynamics is essential for making the right choice.

While buying a home has traditionally been viewed as the American Dream, renting offers flexibility and freedom from maintenance responsibilities. This section examines the core reasons why the rent vs buy debate continues to resonate with so many people.

Market Trends: What The New York Times Says

The New York Times frequently publishes articles analyzing housing market trends. Recent reports highlight a shift in preferences among millennials and Gen Z, who increasingly prioritize flexibility and urban living over homeownership. Meanwhile, Baby Boomers are downsizing and opting for rental properties as they retire.

Key market trends include:

- Rising home prices in major metropolitan areas

- Growing demand for rental properties in suburban neighborhoods

- Increased availability of mortgage options for first-time buyers

These trends underscore the importance of staying informed about the housing market when making your decision.

Financial Implications of Renting vs Buying

Cost Breakdown

One of the primary considerations in the rent vs buy debate is the financial aspect. Buying a home typically involves upfront costs such as a down payment, closing fees, and property taxes. On the other hand, renting requires a security deposit and sometimes a few months' rent upfront.

Read also:Lethal Weapon Actors A Deep Dive Into The Stars Of The Iconic Series

Here’s a breakdown of the costs associated with each option:

- Buying: Mortgage payments, property taxes, insurance, maintenance, and potential appreciation.

- Renting: Monthly rent, utilities, and possible rent increases over time.

Lifestyle Factors to Consider

Your lifestyle plays a significant role in determining whether renting or buying is the better option. For instance, if you value mobility and the ability to relocate easily, renting might be more suitable. Conversely, if you plan to stay in one place for several years and desire stability, buying could be the better choice.

Consider the following lifestyle factors:

- Job stability and career mobility

- Family plans and long-term goals

- Desire for home ownership versus flexibility

Is Buying a Home a Long-Term Investment?

Many people view buying a home as a long-term investment. Historically, real estate has appreciated over time, making homeownership a potentially lucrative venture. However, market fluctuations and economic downturns can impact property values. The New York Times advises buyers to consider the long-term outlook before committing to a purchase.

Key points to consider:

- Historical appreciation rates vary by region

- Maintenance costs can offset potential gains

- Location and neighborhood development influence property value

Emotional Aspects of Renting vs Buying

Psychological Impact

Emotions often play a role in the rent vs buy decision. Owning a home can provide a sense of pride and accomplishment, while renting may offer peace of mind in terms of reduced responsibilities. Understanding the emotional aspects can help you align your decision with your personal values.

Considerations include:

- Sense of belonging and community

- Freedom from maintenance stress

- Flexibility to explore new opportunities

Expert Perspectives on Rent vs Buy

Experts from The New York Times and other reputable sources emphasize the importance of personalized decision-making. Financial advisors often recommend evaluating your financial health, future plans, and risk tolerance before choosing between renting and buying.

Notable insights from experts:

- Focus on your unique circumstances rather than societal norms

- Consider both short-term and long-term implications

- Seek professional advice if needed

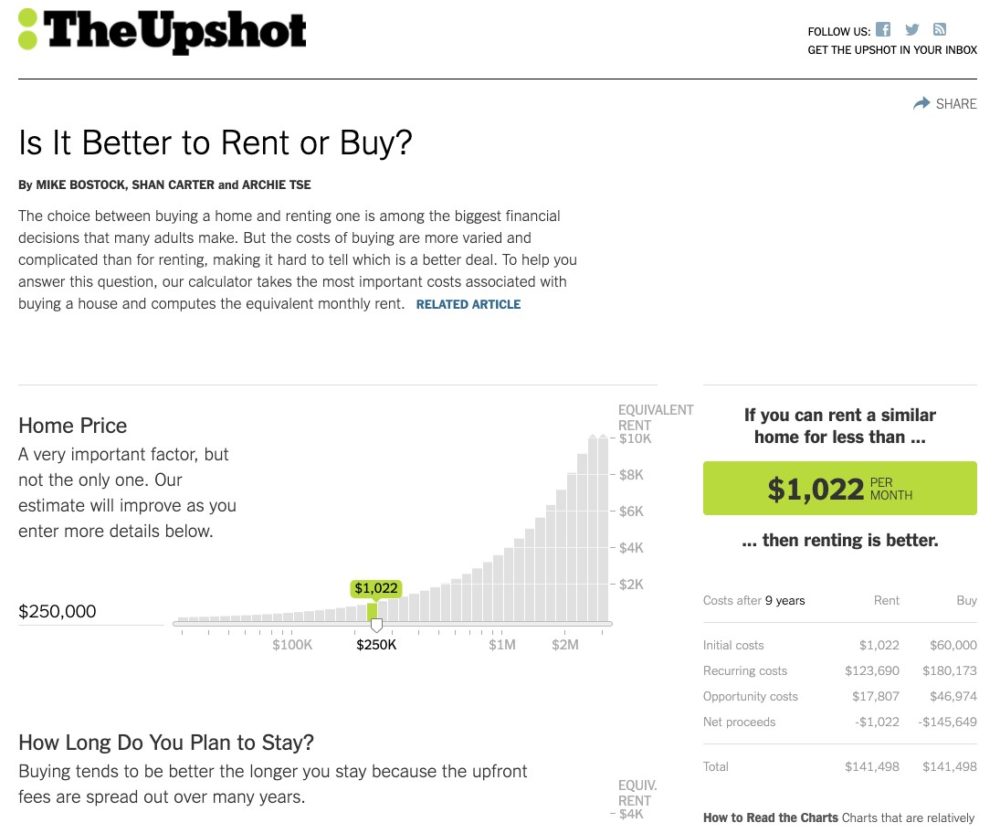

Using a Rent vs Buy Calculator

A rent vs buy calculator can be a valuable tool in helping you assess the financial feasibility of each option. These calculators take into account factors such as home price, interest rates, rental costs, and potential appreciation. The New York Times offers a comprehensive calculator that provides detailed insights based on your inputs.

Steps to use a calculator:

- Input your estimated home price and down payment

- Enter your current rental costs

- Adjust variables like interest rates and property tax

- Review the results to inform your decision

Case Studies: Real-Life Examples

Example 1: Urban Professional

A single professional living in a city center may find renting more advantageous due to the high cost of homeownership in urban areas. This individual values convenience and proximity to work, making renting a more practical choice.

Example 2: Family in the Suburbs

A growing family in the suburbs might prioritize buying a home for stability and space. With plans to stay in the area for the foreseeable future, homeownership aligns with their long-term goals.

Conclusion and Call to Action

In conclusion, the decision to rent or buy a home depends on a variety of factors, including financial considerations, lifestyle preferences, and emotional aspects. Insights from The New York Times and other trusted sources provide valuable guidance for navigating this important decision.

We encourage you to take action by:

- Using a rent vs buy calculator to assess your financial situation

- Considering expert advice and personalized factors

- Sharing your thoughts and experiences in the comments below

For more in-depth analysis and resources, explore additional articles on our website. Your feedback and engagement help us create content that truly matters to you.