In today's dynamic real estate market, the debate over NYT rent vs buy continues to gain momentum. Many individuals find themselves at a crossroads, trying to decide whether renting or buying is the better financial choice. Both options come with their unique advantages and challenges, making it crucial to weigh your options carefully.

The NYT Rent vs Buy calculator has become a popular tool for people seeking clarity on this topic. It offers valuable insights into the financial implications of each option, allowing users to make informed decisions. In this article, we will delve deep into the nuances of renting versus buying, ensuring you have all the information you need to choose wisely.

Whether you're a first-time homebuyer or someone considering a lifestyle change, this guide will provide you with expert advice, real-world examples, and actionable insights. Let's explore the factors that influence the rent vs buy decision and help you navigate this important choice.

Read also:The Band Cream A Timeless Legacy And Their Impact On Rock Music

Understanding the Rent vs Buy Dilemma

The rent vs buy dilemma is a timeless debate that has only intensified in recent years due to fluctuating housing markets and economic uncertainty. At its core, the decision hinges on your financial situation, lifestyle preferences, and long-term goals. Understanding the factors that influence this decision is the first step towards making the right choice.

Factors Influencing the Rent vs Buy Decision

Several key factors come into play when deciding between renting and buying:

- Financial Stability: Evaluate your current financial health and future earning potential.

- Location: Consider the cost of living and property values in your desired area.

- Long-Term Plans: Think about your future plans, including career mobility and family growth.

- Market Conditions: Analyze the current real estate market trends and interest rates.

The NYT Rent vs Buy Calculator: A Valuable Tool

The NYT Rent vs Buy calculator is an invaluable resource for anyone grappling with this decision. It simplifies complex financial calculations, allowing users to input their specific circumstances and receive tailored recommendations. This tool considers variables such as mortgage rates, property taxes, maintenance costs, and potential appreciation.

How the Calculator Works

To use the calculator effectively:

- Enter your current rent amount and estimated home purchase price.

- Provide details about down payment, mortgage terms, and expected property tax rates.

- Adjust sliders to reflect your personal financial assumptions.

- Review the results, which will highlight the break-even point where buying becomes more cost-effective than renting.

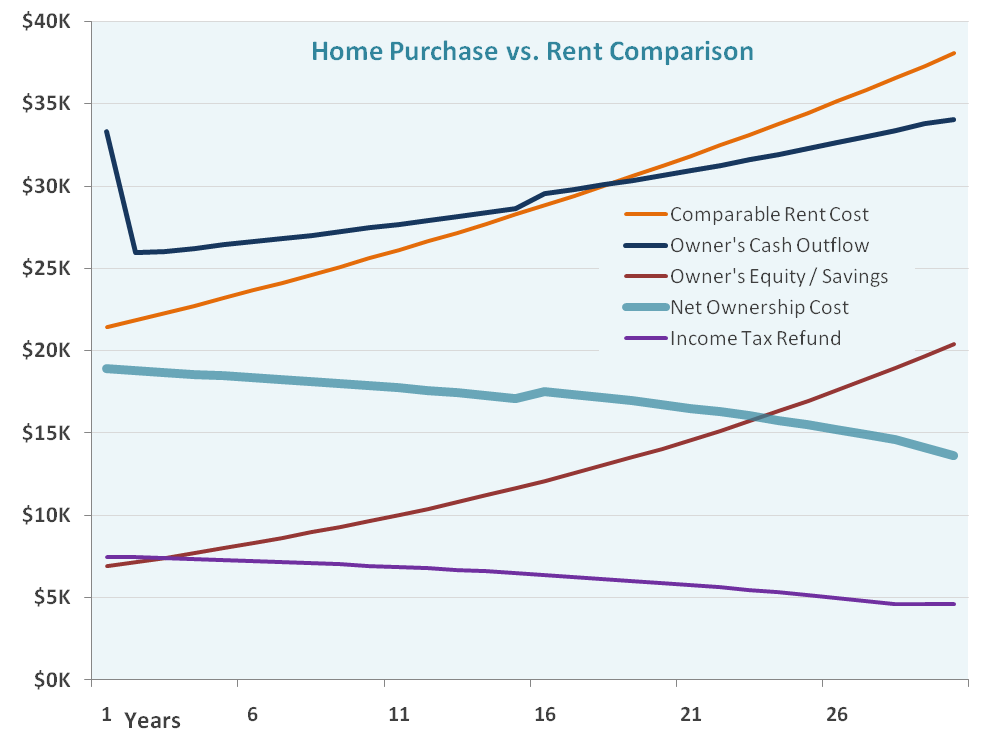

Financial Implications of Renting vs Buying

Understanding the financial implications of each option is crucial. Renting offers flexibility and lower upfront costs, while buying can lead to long-term wealth accumulation through property appreciation.

Cost Comparison: Renting vs Buying

Here's a breakdown of the costs associated with each option:

Read also:Born Oct 23 Zodiac Sign Discover Your Inner Scorpio Strengths And Traits

| Factor | Renting | Buying |

|---|---|---|

| Upfront Costs | Security deposit, first month's rent | Down payment, closing costs |

| Monthly Payments | Rent, utilities | Mortgage, property taxes, insurance |

| Maintenance | Landlord responsibility | Owner responsibility |

Long-Term Benefits of Buying a Home

Buying a home offers several long-term benefits that can make it a wise financial decision:

- Equity Building: As you pay down your mortgage, you build equity in your property.

- Tax Advantages: Homeowners can benefit from tax deductions on mortgage interest and property taxes.

- Appreciation Potential: Real estate often appreciates over time, providing a return on investment.

Flexibility and Freedom of Renting

Renting, on the other hand, provides flexibility and freedom that buying does not:

- No Commitment: Renters can move more easily if their circumstances change.

- Lower Maintenance: Landlords typically handle repairs and maintenance, saving renters time and money.

- Less Financial Risk: Renting avoids the risks associated with property depreciation and market fluctuations.

Market Trends and Economic Factors

Real estate markets are influenced by a variety of economic factors, including interest rates, inflation, and employment trends. Understanding these trends can help you make a more informed decision:

- Interest Rates: Lower rates make buying more affordable, while higher rates increase mortgage costs.

- Inflation: Inflation can erode the value of cash savings, making buying a hedge against rising costs.

- Employment Stability: A stable job market increases confidence in buying a home.

Psychological and Emotional Considerations

While financial considerations are important, psychological and emotional factors also play a role:

- Homeownership Pride: Owning a home can provide a sense of accomplishment and stability.

- Personal Freedom: Renters enjoy the freedom to customize their living space without long-term commitment.

- Community Involvement: Homeowners often feel more connected to their communities.

Expert Advice and Real-World Examples

Seeking advice from real estate experts and analyzing real-world examples can provide valuable insights:

- Consult Professionals: Speak with real estate agents, financial advisors, and mortgage brokers.

- Analyze Case Studies: Look at success stories and lessons learned from others who have made the rent vs buy decision.

Conclusion: Making the Right Choice for You

The NYT Rent vs Buy decision ultimately depends on your unique circumstances and goals. By carefully evaluating your financial situation, considering market trends, and understanding the emotional aspects of homeownership, you can make an informed choice.

We encourage you to take action by exploring the resources mentioned in this article, including the NYT Rent vs Buy calculator. Share your thoughts in the comments below or explore other articles on our site for more insights into real estate and personal finance.

Table of Contents

- Understanding the Rent vs Buy Dilemma

- The NYT Rent vs Buy Calculator: A Valuable Tool

- Financial Implications of Rent vs Buying

- Long-Term Benefits of Buying a Home

- Flexibility and Freedom of Renting

- Market Trends and Economic Factors

- Psychological and Emotional Considerations

- Expert Advice and Real-World Examples

- Conclusion: Making the Right Choice for You