When it comes to choosing between renting and buying a home, it's essential to evaluate your financial situation and long-term goals. The "rent vs buy nyt" debate has been a popular topic, especially with the New York Times offering valuable insights into this decision-making process. Understanding the pros and cons of both options can help you make an informed choice that aligns with your lifestyle and financial priorities.

Many people find themselves at a crossroads when deciding whether to rent or buy a home. While renting offers flexibility and lower upfront costs, buying provides stability and the potential for long-term financial growth. The "rent vs buy nyt" discussion highlights the importance of considering factors such as market conditions, personal preferences, and financial stability.

In this article, we will explore the key aspects of renting versus buying, provide data-driven insights, and help you weigh the pros and cons of each option. By the end of this guide, you will be better equipped to make a well-informed decision that suits your unique circumstances.

Read also:What Is The Difference Between Tablet And Ipad A Comprehensive Guide

Table of Contents

- Introduction to Rent vs Buy

- Financial Aspects of Renting and Buying

- Long-Term Considerations

- Understanding Market Conditions

- Lifestyle Factors to Consider

- The Emotional Appeal of Homeownership

- Insights from the New York Times

- Calculating Costs: Rent vs Buy

- Case Studies: Real-Life Examples

- Conclusion and Final Thoughts

Introduction to Rent vs Buy

The decision to rent or buy a home is one of the most significant financial choices you will make. The "rent vs buy nyt" discussion often centers around the economic implications and lifestyle preferences that influence this decision. Whether you're a young professional or a growing family, understanding the nuances of each option is crucial.

Buying a home can provide a sense of security and stability, while renting offers flexibility and fewer maintenance responsibilities. This section will delve into the fundamental differences between renting and buying, helping you assess which option aligns with your current stage of life.

Financial Aspects of Renting and Buying

Upfront Costs and Long-Term Investment

When evaluating the financial aspects of renting versus buying, it's important to consider upfront costs and long-term investment potential. Buying a home typically requires a down payment, closing costs, and other expenses, whereas renting usually involves a security deposit and first month's rent.

- Buying: Down payment can range from 3% to 20% of the home's value.

- Renting: Lower upfront costs, but no equity accumulation.

According to a study by the National Association of Realtors, homeownership can lead to significant wealth accumulation over time, with home equity increasing as mortgage payments are made and property values appreciate.

Long-Term Considerations

Property Value Appreciation

One of the primary advantages of buying a home is the potential for property value appreciation. Historically, real estate has been a solid long-term investment, with values increasing over time. However, market conditions and economic factors can influence this trend.

For instance, the median home price in the United States increased by 15% in 2021, according to the Federal Reserve. While this is a positive sign for homeowners, it also means that buying a home may require a larger down payment and higher mortgage payments.

Read also:Who Is Billy Unger Married To Exploring The Life And Relationships Of The Talented Actor

Understanding Market Conditions

Interest Rates and Economic Trends

Market conditions play a significant role in the "rent vs buy nyt" decision-making process. Interest rates, housing supply, and demand all affect the cost of buying a home. When interest rates are low, buying becomes more attractive due to lower mortgage payments. Conversely, high interest rates can make renting a more financially viable option.

As of 2023, the Federal Reserve has been adjusting interest rates to manage inflation, which directly impacts mortgage rates. Borrowers should monitor these trends to time their purchase decisions effectively.

Lifestyle Factors to Consider

Flexibility vs Stability

Your lifestyle and personal preferences should also factor into the "rent vs buy nyt" equation. Renting offers flexibility, allowing you to move easily and avoid the responsibilities of homeownership, such as maintenance and repairs. On the other hand, buying a home provides stability and the ability to personalize your living space.

Consider your career path, family plans, and desire for a permanent residence when weighing these options. For example, if you travel frequently for work, renting may be more practical. However, if you envision staying in one location for several years, buying could be a better choice.

The Emotional Appeal of Homeownership

Building Equity and Personal Pride

Homeownership often carries an emotional appeal that goes beyond financial considerations. Owning a home can instill a sense of pride and accomplishment, as well as provide a stable environment for raising a family. Building equity over time also contributes to financial security and wealth accumulation.

According to a survey by the National Association of Home Builders, 84% of respondents believed that owning a home is a good investment. This sentiment reflects the emotional and financial value that homeownership brings to many individuals.

Insights from the New York Times

Expert Opinions and Data-Driven Analysis

The New York Times has published numerous articles and analyses on the "rent vs buy nyt" topic, offering valuable insights from experts in the field. These articles often highlight the importance of considering both financial and personal factors when making this decision.

For example, a 2022 New York Times article emphasized the need to evaluate local market conditions, housing trends, and individual circumstances before committing to either option. The article also provided a rent vs buy calculator to help readers assess their specific situations.

Calculating Costs: Rent vs Buy

Breaking Down the Numbers

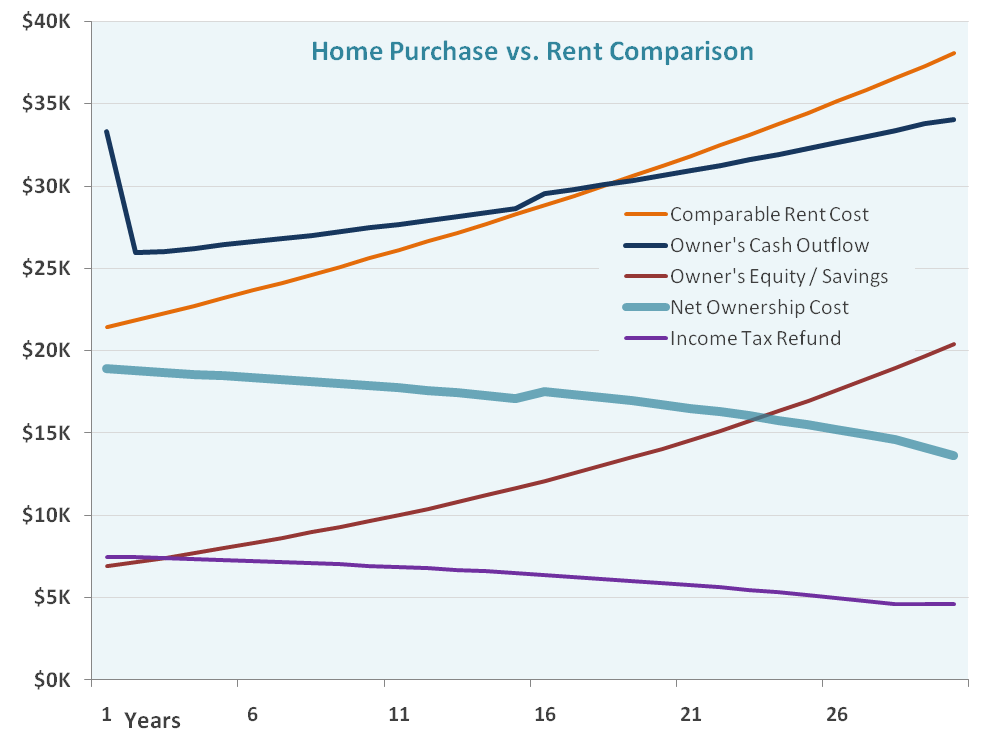

To make an informed decision, it's essential to calculate the costs associated with renting versus buying. This includes not only monthly payments but also additional expenses such as property taxes, insurance, and maintenance costs for homeowners, or rent increases and security deposits for renters.

- Buying: Monthly mortgage payment, property taxes, insurance, maintenance.

- Renting: Monthly rent, utilities, renter's insurance.

A study by Zillow found that in many markets, buying a home is more cost-effective than renting over the long term. However, this varies depending on location and individual circumstances.

Case Studies: Real-Life Examples

Comparing Scenarios

Examining real-life case studies can provide valuable insights into the "rent vs buy nyt" decision-making process. For instance, consider the following scenarios:

- A young professional in a competitive job market may find renting more advantageous due to frequent relocations.

- A growing family looking to settle in a stable neighborhood may benefit from buying a home, as it offers long-term stability and equity accumulation.

These examples illustrate how personal circumstances and priorities can influence the decision to rent or buy.

Conclusion and Final Thoughts

In conclusion, the "rent vs buy nyt" decision requires careful consideration of financial, personal, and emotional factors. While buying a home can provide stability and long-term financial growth, renting offers flexibility and lower upfront costs. By evaluating your unique circumstances and using data-driven tools, you can make a well-informed choice that aligns with your goals.

We encourage you to share your thoughts and experiences in the comments section below. Additionally, explore other articles on our site for more insights into personal finance and real estate. Remember, the right decision for you may differ from others, so take the time to assess your options thoroughly.