When it comes to making one of the most significant financial decisions of your life, the rent vs buy calculator NYTimes offers an invaluable tool to help you weigh the pros and cons of renting versus buying a home. Whether you're a young professional, a growing family, or someone planning for retirement, understanding the financial implications of this choice is crucial.

Homeownership has long been considered the American Dream, but with changing economic landscapes and shifting priorities, renting has become an increasingly attractive option for many. The rent vs buy calculator NYTimes bridges the gap by providing a comprehensive framework to evaluate your unique financial situation.

This article will delve deep into the functionalities, benefits, and considerations of using the rent vs buy calculator NYTimes. Whether you're looking for clarity on long-term investments or short-term flexibility, this guide will provide you with the tools and insights necessary to make an informed decision.

Read also:What Is The Difference Between Tablet And Ipad A Comprehensive Guide

Table of Contents

- Introduction to Rent vs Buy Calculator NYTimes

- Overview of Rent vs Buy Calculator NYTimes

- Benefits of Using Rent vs Buy Calculator NYTimes

- How Rent vs Buy Calculator NYTimes Works

- Key Considerations When Using the Calculator

- Financial Implications of Renting vs Buying

- Long-Term Investment Considerations

- Impact of Real Estate Market Trends

- Alternatives to Rent vs Buy Calculator NYTimes

- Conclusion and Call to Action

- Frequently Asked Questions

Introduction to Rent vs Buy Calculator NYTimes

In today's dynamic real estate market, the decision to rent or buy a home is more complex than ever. The rent vs buy calculator NYTimes simplifies this process by offering a detailed analysis of your financial situation. This tool considers factors such as down payment, mortgage rates, property taxes, and maintenance costs to help you determine the most financially sound option.

For many, the decision to buy a home is driven by the desire for stability and long-term investment. However, renting offers flexibility and freedom from the responsibilities of homeownership. The NYTimes calculator bridges this gap by providing a balanced perspective on both options.

Understanding the nuances of the calculator is essential for anyone looking to make an informed decision. By exploring its features and functionalities, you can gain valuable insights into the financial implications of your choice.

Overview of Rent vs Buy Calculator NYTimes

What is the Rent vs Buy Calculator NYTimes?

The rent vs buy calculator NYTimes is an interactive tool designed to help users evaluate the financial aspects of renting versus buying a home. It takes into account various factors such as home prices, rental costs, mortgage rates, and inflation to provide a comprehensive analysis.

This calculator is particularly useful for individuals who are uncertain about the long-term benefits of homeownership versus the short-term advantages of renting. By inputting your specific financial data, you can receive personalized recommendations tailored to your unique situation.

Who Should Use the Rent vs Buy Calculator NYTimes?

- First-time homebuyers exploring their options

- Individuals considering downsizing or upsizing their living space

- Families evaluating the financial feasibility of homeownership

- Investors looking to assess the potential return on investment in real estate

Whether you're just starting your career or nearing retirement, the rent vs buy calculator NYTimes can provide valuable insights into the financial implications of your housing decisions.

Read also:Roman Reigns Wife A Comprehensive Look Into Her Life And Influence

Benefits of Using Rent vs Buy Calculator NYTimes

Using the rent vs buy calculator NYTimes offers several advantages that can help you make a well-informed decision:

- Comprehensive Analysis: The calculator considers a wide range of financial factors, ensuring a thorough evaluation of your options.

- Personalized Recommendations: By inputting your specific financial data, you receive tailored advice based on your unique situation.

- Flexibility: The tool allows you to adjust various parameters to see how different scenarios impact your decision.

- Trustworthy Source: As a product of The New York Times, the calculator is backed by rigorous research and data analysis.

These benefits make the rent vs buy calculator NYTimes an invaluable resource for anyone navigating the complexities of the housing market.

How Rent vs Buy Calculator NYTimes Works

Step-by-Step Guide to Using the Calculator

Using the rent vs buy calculator NYTimes is straightforward and intuitive:

- Input your estimated home price and down payment.

- Enter your expected monthly rental cost.

- Specify the mortgage rate and loan term.

- Adjust parameters such as property taxes, insurance, and maintenance costs.

- Review the results to see which option aligns better with your financial goals.

This step-by-step process ensures that you have a clear understanding of the financial implications of each choice.

Key Features of the Calculator

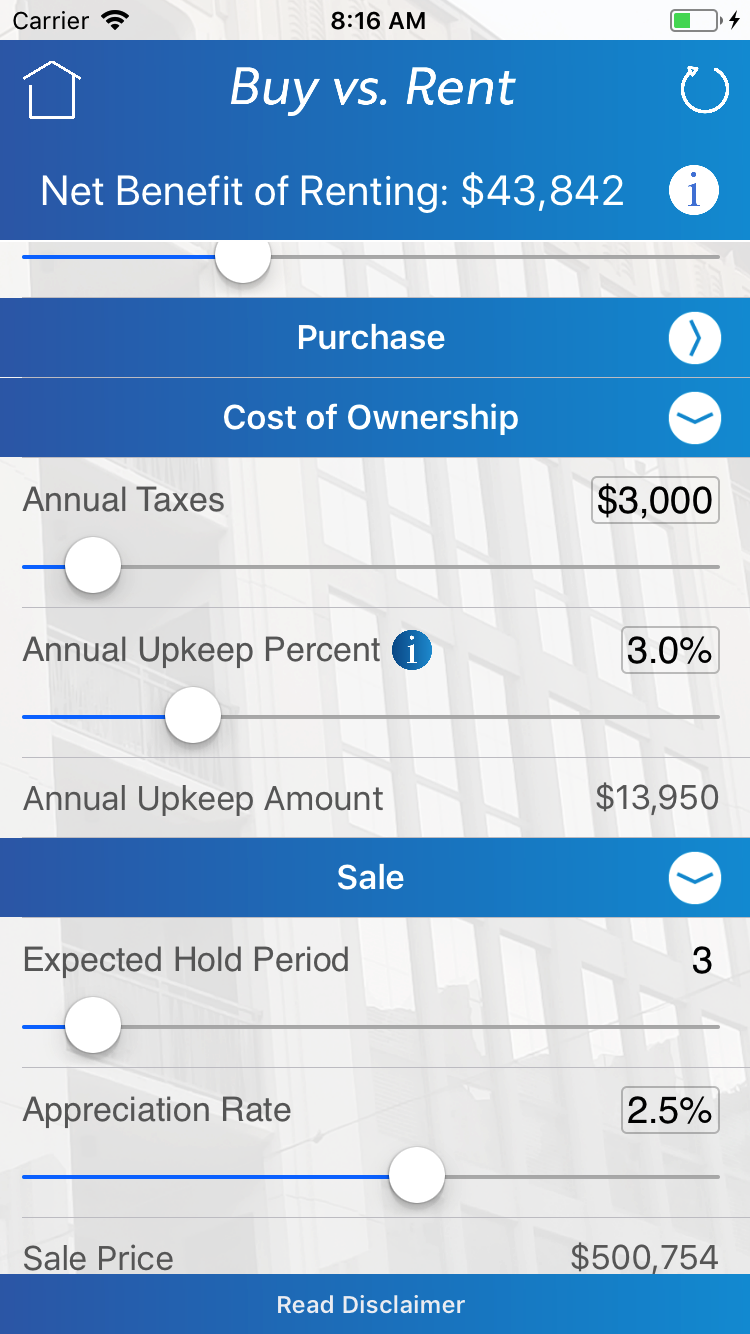

- Dynamic sliders for easy adjustments

- Graphical representations of costs over time

- Customizable scenarios for different financial situations

- Comprehensive breakdown of costs and savings

These features enhance the usability and effectiveness of the calculator, making it a valuable tool for anyone exploring their housing options.

Key Considerations When Using the Calculator

Financial Stability and Long-Term Goals

When using the rent vs buy calculator NYTimes, it's essential to consider your financial stability and long-term goals. Factors such as job security, income growth potential, and retirement plans can significantly impact your decision.

For example, if you anticipate frequent relocations due to career changes, renting might be the more practical option. Conversely, if you plan to settle in one location for an extended period, buying a home could offer better long-term financial benefits.

Market Conditions and Economic Trends

The real estate market is subject to fluctuations influenced by economic trends, interest rates, and housing demand. Understanding these dynamics can help you make a more informed decision when using the calculator.

For instance, during periods of low mortgage rates, buying a home might be more financially advantageous. Conversely, in a buyer's market with high rental demand, renting could be a more cost-effective option.

Financial Implications of Renting vs Buying

The financial implications of renting versus buying a home extend beyond the immediate costs. While buying a home requires a significant upfront investment, it offers potential appreciation and equity accumulation over time. Renting, on the other hand, provides flexibility and freedom from maintenance responsibilities.

According to a report by the Federal Reserve, homeownership can lead to greater wealth accumulation over the long term. However, the same report highlights the importance of considering individual circumstances and market conditions when making this decision.

Long-Term Investment Considerations

Appreciation and Equity

One of the primary advantages of buying a home is the potential for appreciation and equity accumulation. Over time, property values tend to increase, providing homeowners with a valuable asset that can be leveraged for future financial opportunities.

However, it's important to note that appreciation is not guaranteed and can vary significantly based on location and market conditions. The rent vs buy calculator NYTimes helps you assess the potential for appreciation based on historical data and current trends.

Tax Implications

Homeownership comes with certain tax benefits, such as deductions for mortgage interest and property taxes. These benefits can significantly reduce your overall cost of ownership. The calculator takes these factors into account, providing a more accurate comparison of renting versus buying.

Impact of Real Estate Market Trends

Real estate market trends play a crucial role in determining the financial viability of renting versus buying. Factors such as supply and demand, interest rates, and economic conditions can influence the decision-making process.

For instance, during periods of high demand and low supply, buying a home might be more challenging due to increased competition and rising prices. Conversely, in a buyer's market with favorable interest rates, purchasing a home could be a more attractive option.

Alternatives to Rent vs Buy Calculator NYTimes

While the rent vs buy calculator NYTimes is a robust tool, several alternatives offer similar functionalities:

- Zillow's Mortgage Calculator: Provides detailed mortgage estimates and property tax information.

- Bankrate's Rent vs Buy Calculator: Offers a comprehensive analysis of costs and savings over time.

- Realtor.com's Home Affordability Calculator: Helps determine how much house you can afford based on your financial situation.

These alternatives can provide additional perspectives and insights into the rent vs buy decision-making process.

Conclusion and Call to Action

The rent vs buy calculator NYTimes is an invaluable tool for anyone navigating the complexities of the housing market. By providing a comprehensive analysis of financial factors, it empowers users to make informed decisions aligned with their unique circumstances and long-term goals.

We encourage you to explore the calculator and take advantage of its features to gain clarity on your housing options. Don't forget to share your thoughts and experiences in the comments section below. Additionally, consider exploring other articles on our site for more insights into personal finance and real estate.

Frequently Asked Questions

What is the primary purpose of the rent vs buy calculator NYTimes?

The primary purpose of the rent vs buy calculator NYTimes is to help users evaluate the financial implications of renting versus buying a home by considering factors such as home prices, rental costs, mortgage rates, and inflation.

Who benefits the most from using the calculator?

The calculator benefits a wide range of individuals, including first-time homebuyers, families evaluating homeownership feasibility, and investors assessing real estate investment potential.

Are there any limitations to the calculator?

While the calculator provides valuable insights, it relies on user input and assumptions about market conditions. It's essential to consider additional factors such as personal circumstances and economic trends when making a final decision.