Discover how the Heb Credit Card can revolutionize the way you shop, save, and manage your finances. Whether you're a frequent shopper or someone looking for exclusive perks, this credit card offers incredible benefits tailored to your lifestyle.

In today's fast-paced world, having the right financial tools is essential. The Heb Credit Card stands out as a powerful ally for individuals seeking convenience, rewards, and flexibility in their daily transactions. By leveraging its unique features, you can unlock access to exclusive discounts, cashback, and other valuable perks.

This comprehensive guide will walk you through everything you need to know about the Heb Credit Card, including its benefits, eligibility criteria, and how it compares to other credit cards on the market. Our goal is to provide you with actionable insights that help you make informed decisions about your financial future.

Read also:Pretty Little Liars Similar Shows Dive Into The World Of Mystery And Suspense

Table of Contents

- Overview of the Heb Credit Card

- Eligibility Requirements for the Heb Credit Card

- Key Benefits of the Heb Credit Card

- Understanding Fees and Charges

- Rewards Program Details

- How Heb Credit Card Stacks Up Against Competitors

- Security Features of the Heb Credit Card

- How to Apply for the Heb Credit Card

- Tips for Maximizing Your Card Usage

- Frequently Asked Questions About the Heb Credit Card

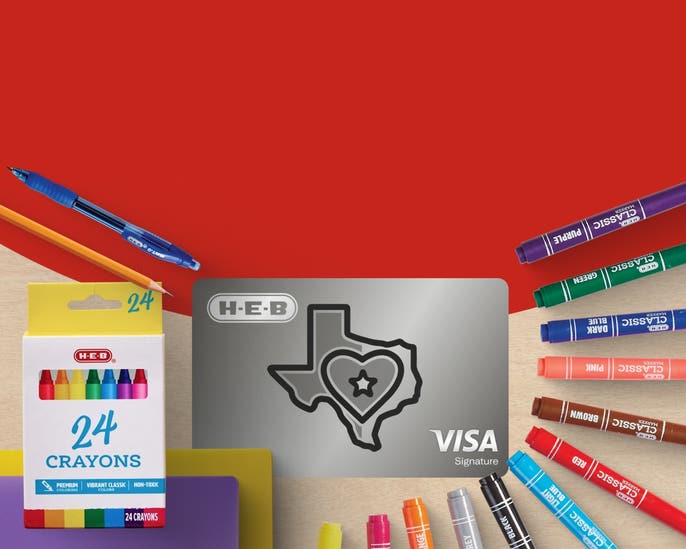

Overview of the Heb Credit Card

The Heb Credit Card has emerged as a popular choice among consumers who value convenience, flexibility, and rewards. Designed specifically for shoppers who frequent Heb stores, this card offers a seamless shopping experience while providing significant savings and perks. Below, we delve into the core features of the card:

Core Features of the Heb Credit Card

- Exclusive discounts on groceries and household items.

- Flexible payment options with competitive interest rates.

- Access to a robust rewards program that rewards loyal customers.

- Convenient online account management tools.

According to a survey conducted by the Federal Reserve, credit cards remain one of the most widely used payment methods in the United States, with over 83% of adults owning at least one card. The Heb Credit Card leverages this trend by offering tailored benefits for its users, making it an attractive option for both new and seasoned credit card holders.

Eligibility Requirements for the Heb Credit Card

Before applying for the Heb Credit Card, it's important to understand the eligibility criteria. While the card is designed to be accessible to a wide range of consumers, certain requirements must be met:

Key Eligibility Criteria

- Applicants must be at least 18 years old.

- A valid Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) is required.

- Proof of income may be requested during the application process.

- A satisfactory credit score is necessary for approval, though the exact threshold may vary.

For individuals with limited credit history, the Heb Credit Card offers a great opportunity to build credit while enjoying the benefits of shopping at Heb stores. According to Experian, maintaining a credit card responsibly can significantly improve your credit score over time.

Key Benefits of the Heb Credit Card

One of the standout features of the Heb Credit Card is its array of benefits designed to enhance your shopping experience. Below, we explore some of the most compelling advantages:

Exclusive Discounts and Promotions

Cardholders enjoy exclusive discounts on groceries, household items, and other essential purchases. These discounts are regularly updated to align with seasonal promotions and special events.

Read also:Long Live Cowgirls T Shirt A Style Statement That Celebrates The Spirit Of The West

Flexible Payment Options

The Heb Credit Card offers flexible payment plans, allowing users to manage their finances effectively. With competitive interest rates and no annual fees, it's an affordable option for everyday use.

Data from the Consumer Financial Protection Bureau (CFPB) indicates that consumers who use credit cards responsibly tend to benefit from lower interest rates and better credit terms over time.

Understanding Fees and Charges

While the Heb Credit Card offers numerous benefits, it's important to be aware of the associated fees and charges. Transparency is key to making informed financial decisions. Here's a breakdown of the most common fees:

Common Fees

- Annual Fee: The Heb Credit Card does not charge an annual fee, making it an attractive option for budget-conscious consumers.

- Interest Rate: The card offers competitive interest rates, which vary based on the user's creditworthiness.

- Late Payment Fee: A late payment fee of up to $40 may apply if payments are not made on time.

For more detailed information, refer to the official Heb Credit Card website or contact customer service for clarification.

Rewards Program Details

The Heb Credit Card rewards program is one of its most appealing features. By earning points or cashback on eligible purchases, cardholders can maximize the value of their spending. Below, we outline the specifics of the rewards program:

How the Rewards Program Works

- Earn 3% cashback on purchases made at Heb stores.

- Receive 2% cashback on gas purchases.

- Enjoy 1% cashback on all other eligible purchases.

Statistics from the National Retail Federation show that consumers who participate in rewards programs tend to spend more at participating retailers. The Heb Credit Card capitalizes on this trend by offering generous rewards that encourage repeat business.

How Heb Credit Card Stacks Up Against Competitors

When comparing the Heb Credit Card to other retail credit cards, it's essential to evaluate the features, benefits, and drawbacks. Below, we compare the Heb Credit Card to some of its competitors:

Comparison Chart

| Feature | Heb Credit Card | Competitor A | Competitor B |

|---|---|---|---|

| Annual Fee | No | $50 | $75 |

| Cashback Rate | 3% at Heb | 2% at Partner Stores | 1.5% on All Purchases |

| Interest Rate | 12.99%-24.99% | 15.99%-27.99% | 14.99%-25.99% |

As the chart illustrates, the Heb Credit Card offers competitive rates and benefits, making it a strong contender in the retail credit card market.

Security Features of the Heb Credit Card

Security is a top priority for any credit card provider. The Heb Credit Card incorporates advanced security measures to protect cardholders from fraud and unauthorized transactions. Below, we highlight some of the key security features:

Security Features

- Chip-and-PIN technology for enhanced security.

- 24/7 fraud monitoring to detect suspicious activity.

- Zero Liability Protection ensures cardholders are not held responsible for unauthorized transactions.

According to Javelin Strategy & Research, credit card fraud has increased in recent years, underscoring the importance of robust security measures. The Heb Credit Card addresses these concerns by offering comprehensive protection for its users.

How to Apply for the Heb Credit Card

Applying for the Heb Credit Card is a straightforward process that can be completed online or in-store. Below, we outline the steps to follow:

Steps to Apply

- Visit the official Heb Credit Card website or approach a customer service representative at a Heb store.

- Fill out the application form, providing accurate and complete information.

- Submit the application and wait for a decision, which is typically provided within a few minutes.

For additional assistance, contact Heb customer service at the number provided on their website.

Tips for Maximizing Your Card Usage

To get the most out of your Heb Credit Card, consider implementing the following tips:

Maximizing Your Benefits

- Use the card for eligible purchases to earn maximum cashback.

- Set up automatic payments to avoid late fees and maintain a good credit score.

- Monitor your account regularly for unauthorized transactions.

By following these tips, you can ensure that your Heb Credit Card serves as a valuable tool for managing your finances effectively.

Frequently Asked Questions About the Heb Credit Card

Below, we address some of the most common questions about the Heb Credit Card:

FAQs

- Is there an annual fee for the Heb Credit Card? No, the Heb Credit Card does not charge an annual fee.

- What is the cashback rate for purchases made at Heb stores? Cardholders earn 3% cashback on purchases made at Heb stores.

- How can I check my account balance? You can check your account balance online through the official Heb Credit Card website or by contacting customer service.

Kesimpulan

In conclusion, the Heb Credit Card offers a compelling combination of benefits, flexibility, and security for consumers who value convenience and rewards. By understanding its features, eligibility criteria, and usage tips, you can make the most of this powerful financial tool. We encourage you to explore the card's offerings and consider how it aligns with your financial goals.

Take the next step by applying for the Heb Credit Card today and start enjoying the numerous benefits it has to offer. Don't forget to share your experiences with us in the comments below or explore other informative articles on our website for more financial insights.