When it comes to the age-old debate of rent vs buy, there is no shortage of opinions and advice. The New York Times has long been a trusted source for information on this topic, providing readers with valuable insights and data to help them make informed decisions. Whether you're a first-time homebuyer or considering a long-term rental, understanding the nuances of this decision is crucial for your financial future.

The NYTimes rent vs buy debate offers a wealth of information that delves into the economic, personal, and lifestyle factors that influence this choice. With skyrocketing housing prices, fluctuating interest rates, and evolving market conditions, the decision to rent or buy is more complex than ever. This article aims to provide a detailed analysis of the key considerations involved in this decision-making process.

As you explore the NYTimes rent vs buy resources, you will discover a range of tools, calculators, and expert opinions that can help you weigh the pros and cons of each option. By the end of this article, you will have a clearer understanding of the factors that influence this decision and how to align your choice with your financial goals and lifestyle preferences.

Read also:Chinese Calendar True Or False Ndash Unveiling The Truth Behind The Ancient Timekeeping System

Understanding the NYTimes Rent vs Buy Calculator

What is the Rent vs Buy Calculator?

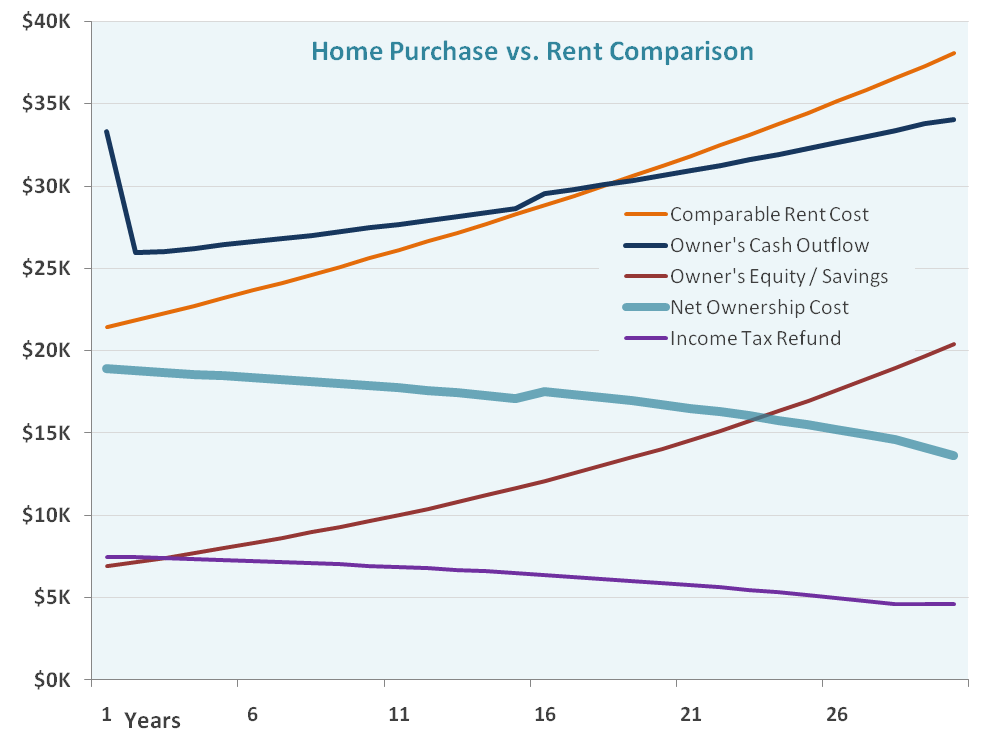

The NYTimes rent vs buy calculator is a powerful tool designed to help individuals assess whether renting or buying a home is the better financial decision for their specific situation. This calculator takes into account various factors such as home price, down payment, mortgage rate, property taxes, maintenance costs, and expected appreciation or depreciation of the property. By inputting your personal financial data, you can get a clearer picture of the long-term costs associated with each option.

For example, the calculator considers:

- Home price and down payment

- Mortgage interest rates and term

- Property taxes and insurance

- Estimated maintenance and repair costs

- Expected appreciation or depreciation of the property

- Rental costs and potential investment returns

How to Use the Rent vs Buy Calculator

Using the NYTimes rent vs buy calculator is straightforward. Simply input your estimated home price, down payment, mortgage rate, and other relevant financial information. The calculator will then generate a detailed comparison of the costs associated with renting versus buying over a specified period. This allows you to see the long-term financial implications of each choice and make an informed decision.

Key Considerations in the Rent vs Buy Debate

Financial Implications

One of the most important aspects of the NYTimes rent vs buy discussion is the financial implications of each option. Buying a home typically involves a significant upfront cost in the form of a down payment, as well as ongoing expenses such as mortgage payments, property taxes, and maintenance. On the other hand, renting offers more flexibility and lower upfront costs, but may result in higher long-term expenses depending on market conditions.

Lifestyle Preferences

Your lifestyle preferences also play a crucial role in the NYTimes rent vs buy decision. If you value flexibility and the ability to relocate easily, renting may be the better option. However, if you prefer stability and the potential for long-term wealth accumulation through home ownership, buying may align more closely with your goals. Consider factors such as job stability, family plans, and personal priorities when making this decision.

Market Conditions

Market conditions are another critical factor to consider in the NYTimes rent vs buy analysis. Factors such as housing prices, interest rates, and rental market trends can significantly impact the financial viability of each option. For instance, in a market with rapidly rising home prices, buying may offer better long-term value. Conversely, in a market with high rental demand, renting may provide more stability and predictability.

Read also:The Junior League Empowering Women Through Community Service And Leadership

Advantages of Renting

Flexibility and Mobility

One of the primary advantages of renting, as highlighted in the NYTimes rent vs buy debate, is the flexibility it offers. Renters can easily move to new locations, take advantage of job opportunities, or adapt to changing life circumstances without the burden of selling a property. This makes renting an attractive option for individuals who prioritize mobility and adaptability.

Lower Upfront Costs

Renting typically requires lower upfront costs compared to buying a home. Renters do not need to worry about down payments, closing costs, or other expenses associated with purchasing a property. This makes renting a more accessible option for individuals who may not have the financial resources to buy a home outright.

Minimal Maintenance Responsibilities

Renters also benefit from minimal maintenance responsibilities. Most repairs and maintenance tasks are handled by the landlord or property management company, allowing renters to focus on other priorities. This can be particularly appealing for individuals who prefer a hassle-free living arrangement.

Advantages of Buying

Building Equity

One of the key advantages of buying a home, as emphasized in the NYTimes rent vs buy discussion, is the opportunity to build equity. As you pay down your mortgage and the value of your property appreciates, you accumulate wealth that can be accessed through home equity loans or realized when you sell the property. This makes home ownership a valuable long-term investment.

Stability and Control

Buying a home provides stability and control over your living environment. Homeowners can personalize their space, make improvements, and enjoy the peace of mind that comes with knowing they have a permanent residence. This can be particularly appealing for individuals and families who value long-term stability and security.

Potential Tax Benefits

Homeowners may also benefit from tax advantages, such as deductions for mortgage interest and property taxes. These tax benefits can reduce your overall cost of ownership and make buying a more financially attractive option in certain situations.

Common Misconceptions in the Rent vs Buy Debate

Renting is Always a Waste of Money

One common misconception in the NYTimes rent vs buy discussion is that renting is always a waste of money. While it is true that renters do not build equity, renting can be a financially sound decision in certain circumstances. For example, in markets with high property values and uncertain appreciation, renting may offer better value over the long term.

Buying is Always the Better Investment

Another misconception is that buying is always the better investment. While home ownership can lead to wealth accumulation, it is not without risks. Factors such as market fluctuations, economic downturns, and unexpected expenses can impact the financial viability of buying a home. It is important to carefully evaluate your personal circumstances and market conditions before making this decision.

Expert Opinions on Rent vs Buy

Real Estate Experts Weigh In

According to real estate experts featured in the NYTimes rent vs buy articles, the decision to rent or buy should be based on a combination of financial, personal, and market factors. Experts emphasize the importance of conducting a thorough analysis of your financial situation, lifestyle preferences, and market conditions before making a decision.

Economists' Perspective

Economists also offer valuable insights into the NYTimes rent vs buy debate. They highlight the importance of considering opportunity costs, such as the potential returns on alternative investments, when evaluating the financial implications of each option. This perspective encourages individuals to think beyond the immediate costs and benefits of renting or buying and consider the broader financial landscape.

Data and Statistics on Rent vs Buy

National Trends

According to data from the U.S. Census Bureau and other reliable sources, the trend toward renting has been increasing in recent years. Factors such as rising housing prices, student loan debt, and changing lifestyle preferences have contributed to this shift. Understanding these national trends can provide valuable context for your personal decision-making process.

Regional Variations

Regional variations in the NYTimes rent vs buy landscape also play a significant role in the decision-making process. For example, in urban areas with high housing costs, renting may be the more financially viable option. Conversely, in suburban or rural areas with lower housing prices, buying may offer better value. Analyzing regional data can help you make a more informed decision based on your location.

Conclusion and Call to Action

In conclusion, the NYTimes rent vs buy debate offers valuable insights and tools to help individuals make informed decisions about their housing choices. By carefully evaluating the financial, personal, and market factors involved, you can determine which option aligns best with your goals and circumstances. Remember to use the NYTimes rent vs buy calculator and other resources to conduct a thorough analysis of your options.

We invite you to share your thoughts and experiences in the comments section below. Have you faced the rent vs buy dilemma? What factors influenced your decision? Additionally, feel free to explore our other articles on personal finance and real estate for more valuable information. Thank you for reading, and we hope this article has provided you with the guidance you need to make the right choice for your future.

Table of Contents