The debate over renting versus buying a home has always been a hot topic, especially in today’s dynamic real estate market. The NYTimes Rent vs Buy Calculator has emerged as a powerful tool to help individuals make informed decisions about their housing options. Whether you're a first-time homebuyer or someone reconsidering your living arrangements, understanding the financial implications of renting versus buying is crucial. This article dives deep into the calculator's functionality, its benefits, and how it can assist you in making smarter financial choices.

Homeownership has long been considered a cornerstone of financial stability, but with rising property prices and fluctuating rental rates, the decision to buy or rent isn't as straightforward as it once was. The NYTimes Rent vs Buy Calculator simplifies this complex decision by offering personalized insights based on your unique financial situation.

In this comprehensive guide, we’ll explore the features of the calculator, its relevance in today’s economic landscape, and how it aligns with your financial goals. By the end of this article, you’ll have a clear understanding of whether renting or buying is the better option for you.

Read also:Chinese Gender Prediction Unveiling The Secrets Of Ancient Chinese Wisdom

Table of Contents

- Introduction to Rent vs Buy Calculator

- The History of the NYTimes Rent vs Buy Calculator

- Key Features of the NYTimes Rent vs Buy Calculator

- Benefits of Using the Calculator

- How the NYTimes Rent vs Buy Calculator Works

- Factors to Consider When Using the Calculator

- Long-Term Financial Implications

- Real-World Examples and Case Studies

- Tips for Maximizing the Calculator’s Potential

- Alternatives to the NYTimes Rent vs Buy Calculator

- Conclusion and Call to Action

Introduction to Rent vs Buy Calculator

The NYTimes Rent vs Buy Calculator is an innovative tool designed to help individuals navigate the complexities of housing decisions. By inputting specific financial data, users can determine whether renting or buying a home is more financially advantageous in their current situation.

Why Use a Rent vs Buy Calculator?

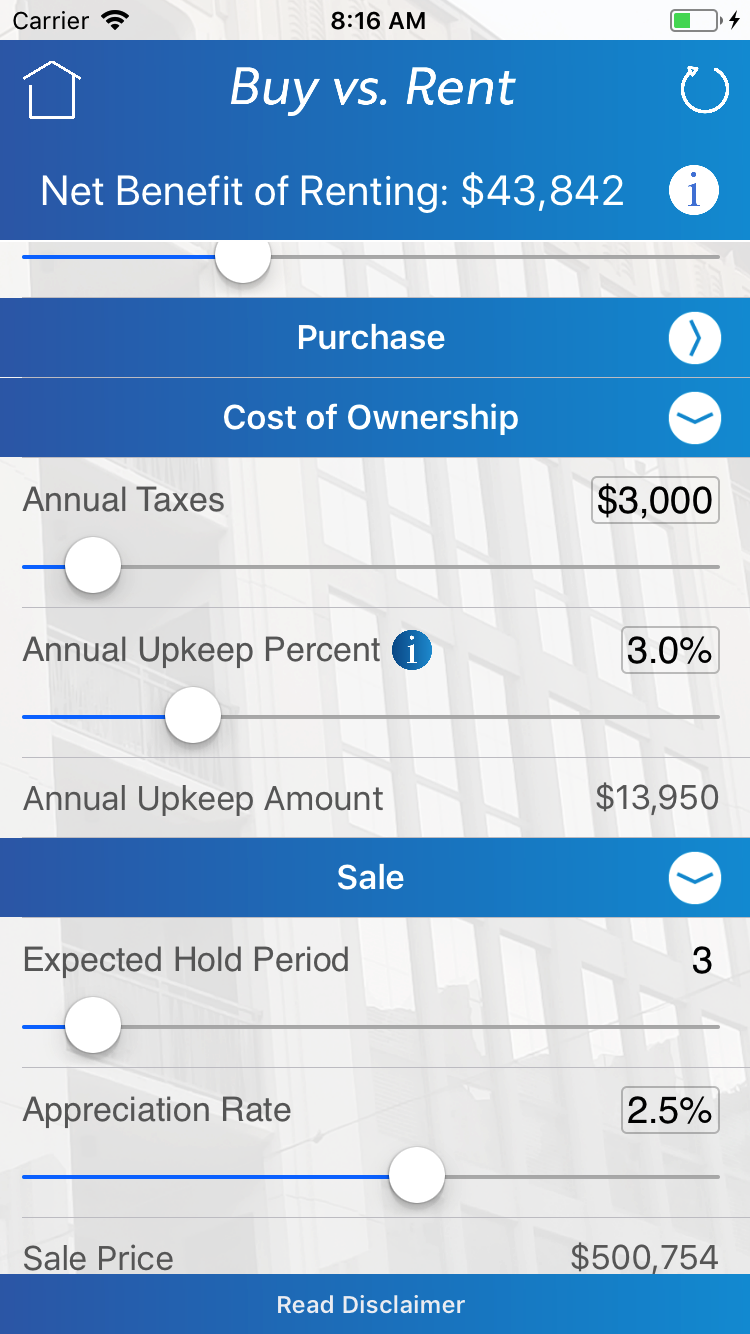

Choosing between renting and buying involves more than just comparing monthly payments. The calculator considers factors such as property taxes, maintenance costs, mortgage interest rates, and potential appreciation or depreciation of property values. These variables can significantly impact your long-term financial health.

Who Can Benefit from the NYTimes Rent vs Buy Calculator?

- First-time homebuyers

- Individuals reconsidering their current living arrangements

- Investors evaluating property purchases

- Anyone seeking clarity on housing costs

The History of the NYTimes Rent vs Buy Calculator

The New York Times introduced the Rent vs Buy Calculator as part of its commitment to providing readers with practical, data-driven tools to assist in major life decisions. Since its inception, the calculator has been refined to incorporate the latest economic data and user feedback, ensuring its relevance in today’s ever-changing housing market.

Evolution of the Calculator

Over the years, the calculator has evolved to include additional features such as customizable assumptions about inflation rates, property value growth, and tax implications. These enhancements make it even more versatile and applicable to a wide range of users.

Key Features of the NYTimes Rent vs Buy Calculator

The NYTimes Rent vs Buy Calculator stands out due to its comprehensive approach to analyzing housing costs. Here are some of its key features:

- Customizable Inputs: Users can adjust variables such as down payment amounts, mortgage interest rates, and expected property value appreciation.

- Comprehensive Cost Analysis: The calculator accounts for both visible and hidden costs associated with homeownership, including property taxes, insurance, and maintenance expenses.

- Interactive Charts: Visual representations of data make it easier for users to understand the financial implications of their choices.

Benefits of Using the Calculator

Using the NYTimes Rent vs Buy Calculator offers several advantages:

Read also:Park City Piste Map Your Ultimate Guide To Exploring The Best Ski Runs

1. Clarity and Transparency

The calculator provides a clear breakdown of costs, helping users understand the true financial commitment involved in either renting or buying.

2. Personalized Results

By tailoring inputs to individual circumstances, the calculator delivers results that are relevant and actionable for each user.

How the NYTimes Rent vs Buy Calculator Works

Using the calculator is straightforward. Users input basic information about their financial situation, including:

- Monthly rent amount

- Purchase price of the desired property

- Down payment percentage

- Mortgage interest rate

- Estimated property tax rate

Once the data is entered, the calculator generates a detailed comparison of the costs associated with renting versus buying over a specified time horizon.

Factors to Consider When Using the Calculator

While the NYTimes Rent vs Buy Calculator is a valuable tool, it’s important to consider additional factors that may influence your decision:

1. Economic Conditions

Fluctuations in the economy, such as changes in interest rates or inflation, can impact housing costs and the calculator’s projections.

2. Personal Preferences

Your lifestyle and long-term goals should also play a role in determining whether renting or buying is the better option for you.

Long-Term Financial Implications

One of the primary advantages of the NYTimes Rent vs Buy Calculator is its ability to project long-term financial outcomes. By factoring in variables such as inflation and property value appreciation, the calculator provides a more accurate picture of the potential return on investment in homeownership.

Building Equity

Buying a home allows you to build equity over time, which can be a significant financial asset. The calculator helps you estimate how much equity you could accumulate based on your mortgage terms and property value growth assumptions.

Real-World Examples and Case Studies

Let’s explore a few real-world examples to illustrate how the NYTimes Rent vs Buy Calculator can assist in making informed housing decisions:

Case Study 1: Urban Professional

A young professional living in a major city inputs their financial data into the calculator and discovers that buying a home is more cost-effective over a 10-year horizon due to rising rental rates and moderate property value appreciation.

Case Study 2: Family Seeking Stability

A family considering a move to a suburban area uses the calculator to compare renting versus buying a home. They find that while the initial costs of buying are higher, the long-term savings make homeownership the better choice.

Tips for Maximizing the Calculator’s Potential

To get the most out of the NYTimes Rent vs Buy Calculator, consider the following tips:

- Be as accurate as possible when entering financial data.

- Experiment with different scenarios to see how changes in variables affect the results.

- Consult with a financial advisor to gain deeper insights into your housing options.

Alternatives to the NYTimes Rent vs Buy Calculator

While the NYTimes Rent vs Buy Calculator is a robust tool, there are other resources available for evaluating housing costs:

1. Zillow Rent vs Buy Calculator

Zillow offers a similar tool that includes additional features such as neighborhood-specific data.

2. Bankrate Mortgage Calculator

Bankrate provides a mortgage calculator that can help you estimate monthly payments and total costs associated with buying a home.

Conclusion and Call to Action

The NYTimes Rent vs Buy Calculator is an invaluable resource for anyone grappling with the decision of whether to rent or buy a home. By providing a detailed analysis of costs and long-term financial implications, it empowers users to make informed choices aligned with their goals and circumstances.

We encourage you to try the calculator and explore the various scenarios that apply to your situation. Share your experiences in the comments section below, and don’t forget to check out our other articles for more financial insights and advice.

Remember, your housing decision is a significant financial commitment. Use tools like the NYTimes Rent vs Buy Calculator to ensure you’re making the best choice for your future.